Consumption led the recovery of demand, automotive textile clothing momentum is good, the post-cycle category marginal improvement

Consumption has led us to a recovery in demand. From January to October in 2023, the total amount of social organizations in China was + 6.9% year-on-year, showing a moderate recovery trend. In terms of items, the consumption of textile clothing, petroleum products and automobiles recovered well. From January to October, the total was 10.2%, 6.4% and 5.3% respectively, which was better than the average growth rate of total retail sales of enterprises above designated size (5.2%). While furniture, home appliances, decoration materials and other real estate cycle categories are weak, but there have been signs of marginal improvement.

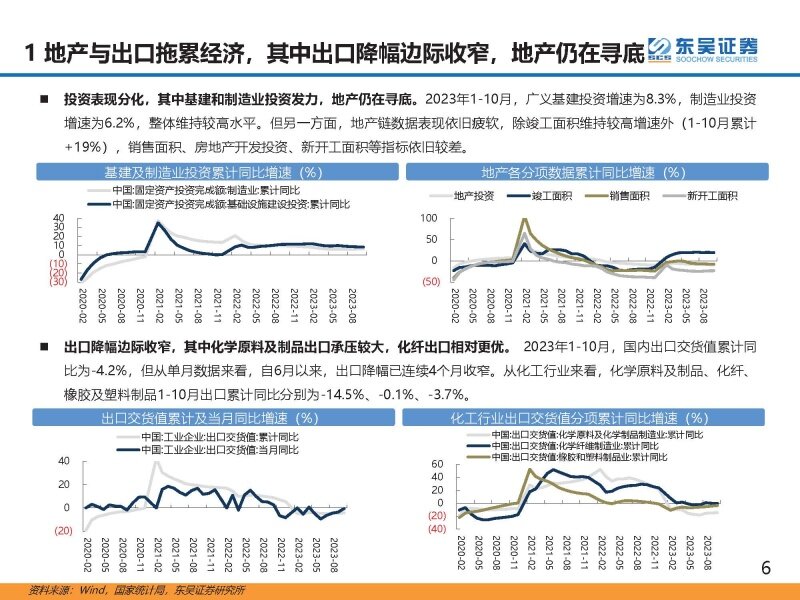

Property and exports drag down the economy, with exports in the margin narrowing, and property is still finding a bottom

Investment performance is divided, with infrastructure and manufacturing investment driving, and real estate is still finding a bottom. From January to October in 2023, the growth rate of broad infrastructure investment was 8.3%, and that of manufacturing investment was 6.2%, maintaining a high level overall. But on the other hand, the performance of the real estate chain data is still weak, in addition to the completed area maintained a high growth rate (cumulative + 19% from January to October), sales area, real estate development investment, new construction area and other indicators are still poor.

The margin of export decline narrowed, among which the export of chemical raw materials and products was under greater pressure, and the export of chemical fiber products was relatively better. From January to October 2023, the cumulative value of domestic export delivery was-4.2% compared with the same period last year. However, from the single month data, the decline in exports has narrowed for four consecutive months since June. From the perspective of chemical industry, the cumulative export of chemical raw materials and products, chemical fiber, rubber and plastic products from January to October was-14.5%, -0.1% and-3.7% respectively year-on-year.

The profit margin of chemical enterprises stabilized, and the operating cash flow improved significantly

Revenue basically stabilized, and the decline in earnings narrowed. From January to October 2023, the revenue growth rate of China's chemical raw materials and products, chemical fiber, rubber and plastic products enterprises was-5%, 4% and 1% respectively, and the total profit growth rate was 43%, 2% and 16% respectively. Among them, the downstream chemical fiber and plastics took the lead in repair, and the performance of bulk chemicals in the upstream is relatively poor. Operating cash flow has improved significantly. We counted the operating cash flow of basic chemical industry and petrochemical industry (excluding oil and gas exploitation and oil service) enterprises, among which the operating net cash flow in 2023Q3 was 257.5 billion yuan, up 5% year-on-year and 8% month-on-month.

Supply pressure still exists, the preferred differentiation route and the fundamentals of better sub-industries

The supply side may restrict the elasticity of this cycle. The demand side determines the turning point of this cycle, and the supply side determines the elasticity of this cycle. Looking forward to 2024, the construction in the chemical industry will still be continuously converted into new capacity, and the chemical prices will be suppressed. In this context, we need to be in two directions to find opportunities: 1) for those who improve supply and demand industry, need to optimize inventory cycle first bottom, supply growth relatively restrained varieties, 2) for those who supply and demand to improve the industry, need to work on the cost, optimization with differentiation cost advantage, and low cost capacity expansion ability of the target.

To be specific, it is suggested to focus on the following four main lines: 1) Main line 1: The oil price maintains a medium-high level, and continuously recommend the layout opportunities of ethane cracking and coal to olefin.2) Main line 2: the synchronization and promotion of warehousing at home and abroad, and the inventory cycle is expected to usher in an inflection point. It is suggested to pay attention to the high elasticity of supply growth restraint such as polyester filament.3) Main line 3: the valuation of large and coal chemical enterprises is bottom. It is suggested to pay attention to the leading targets with strong cost advantages and counter-cyclical expansion ability.4) Main line 4: new materials are still the core point, it is suggested to pay attention to POE and other domestic replacement space is large, and have the ability of industrialization landing varieties.

Main line 1: high oil price operation, differentiation line continues to benefit

High oil prices run, oil and gas price spreads widened

Crude oil prices to maintain a high shock, natural gas, thermal coal prices fell.1) In the Federal Reserve interest rate hike, OPEC + production cut, Palestine-Palestinian conflict and other factors, the overall oil price remains range concussion. As of December 8, the average annual price of oil was $82.4 / barrel, -17% / + 16% compared with 22 / 21 respectively 2) The European natural gas crisis ended, and the gas price returned to medium low, as of December 8, the average annual price of US natural gas was $2.68 / mmbtu, -59% / -28% compared with 22 / 21 respectively.3) Coal supply is gradually easing, and the coal price is falling. As of December 8, the average price of domestic thermal coal is 845 yuan / ton, which is-13% / -0% compared with the average price of 22 / 21. Oil and gas price difference widened, gas chemical industry, coal chemical industry relative benefit. As of December 8, the coal oil price difference between crude oil and natural gas and crude oil and power increased by 18% / 19% respectively compared with the beginning of the year, and increased by 130% / 37% compared with the lowest point of last year, and the advantages of coal chemical industry and gas chemical industry expanded.

Diversified olefin process routes, raw material price is the key to competitiveness

Olefin production mainly includes oil and gas three routes.1) Oil manufacturing route refers to the preparation of olefins by steam cracking and catalytic cracking, in which naphtha is cracked into smaller molecules at high temperature, and then forms gaseous light olefin by free radical reaction; 2) Coal manufacturing route refers to the preparation of olefins by methanol dehydration, which is divided into CTO / MTO / MTP. The difference is mainly whether methanol is purchased and the yield of propylene in the product; 3) temperament route (light hydrocarbon cracking) mainly includes ethane understanding and propane dehydrogenation, which refers to the preparation of ethylene and propylene from ethane or propane in high temperature cracking furnace. The oil production route is the most important olefin production method at present, accounting for about 73% / 56% of the total ethylene / propylene production capacity. At present, the global pricing of olefin products is mainly based on the oil production route.

Main line 2: inventory cycle switch, focusing on the supply and demand improvement sub-direction

Since the beginning of the year, polyester filament price, the overall improvement

Since the beginning of the year, with the end repair of the demand, polyester filament profit showed a trend of improvement quarter by quarter. After entering Q4, affected by the off-season demand fall and oil price correction, filament profit under pressure, but with the temperature decreased in autumn and winter fabric orders improved, since late November filament profit rebounded again, as of the week of December 8, POY / FDY / DTY / PTA industry average profit rebounded to 55 / 206 / 97 / -92 yuan / ton, the overall has been better than the Q3 average level.

Silk operating rate rebounded significantly, inventory levels at a low level in the same period

High starts and low inventory in parallel. In the week ended December 8, the operating rate of polyester filament filament was 85.6%, at the high level in the same period, while the inventory days of POY / FDY / DTY were 13.6/18.4/24.5 days respectively, both at the low level in the same period. The high construction has diluted the production cost per ton of filament enterprises, thickening the profits of leading enterprises, and the products produced are fully absorbed by the downstream links, making the inventory level always maintain low.

Downstream textile and service demand stabilized, and direct exports increased higher year-on-year

The end demand performed well, and the filament export volume increased rapidly. From the perspective of end demand performance, from January to October, domestic textile retail sales increased by 10.2% year on year, the year-on-year decline in revenue and profit of textile industry continued to narrow, and the recovery momentum of domestic demand was good. As of the week of December 8, the operating rate of downstream looms in Jiangsu and Zhejiang regions was 68.9%, at the high level of the same period, and further increased compared with the Q3 level, showing a weak market in the off-season. On the other hand, the export volume of polyester filament silk from January to October reached 2.84 million tons, up 32% year on year, already exceeding the level of the whole year of last year.

Europe and the United States inventory cycle switch, the export chain or usher in investment opportunities

The us stocking cycle is coming to an end, and domestic exports are expected to improve marginal. Domestic export data are closely related to the overseas inventory cycle, overseas warehousing corresponds to the pressure of domestic export, and overseas replenishment corresponds to the improvement of domestic export. Since September 2022, the United States has entered the cycle of active destocking, corresponding to the continuous year-on-year decline in domestic exports, which has had a great impact on the export chain enterprises. Even today, however, the year-on-year growth rate of inventories in the US has fallen to a historic low, the inventory-sales ratio has returned to the central level, while the manufacturing PMI marginal stabilized, and a number of indicators point to the end of the inventory cycle. Domestically, due by price factors, the two-year year-on-year decline in export amount is still expanding, but the actual export volume has resumed growth. Looking back, with the start of the overseas replenishment cycle in 2024, enterprises related to the export chain are expected to usher in investment opportunities.

Main line three: leading valuation to build the bottom, focus on counter-cyclical expansion opportunities

Refined oil products: demand is resilient, and production and sales remain stable

Demand for refined oil products sharing has increased. Since the beginning of the year, the recovery of the epidemic has been steadily promoted, especially the rapid release of road travel demand. At the same time, many major domestic infrastructure projects have been started, promoting the profit of refined oil products. Specifically, from January to October 2023, domestic gasoline / diesel / jet coal production was 11,050 / 14769 / 34.58 million tons respectively, with a year-on-year increase of 14.8% / 20.3% / 88.6% respectively.

PX: Production expansion in 2023 will end, and the profit center will gradually move up

The domestic oil refining scale has approached the red line of 1 billion tons, and the pace of refinery construction will slow down significantly in the future, and the growth rate of aromatic hydrocarbon production capacity is expected to decline. Carbon neutral background, domestic new refineries for examination and approval of sharply tightened, according to the State Council issued by the printing of carbon 2030 years ago action plan notice, by 2025 domestic crude oil processing capacity to control within 1 billion tons, and according to the China's oil circulation industry development blue book (2022-2023), China refining capacity in 2022 has reached 937 million tons. Looking forward to the future market, we believe that the peak of domestic refining energy growth has passed, and the pace of refinery construction will slow down significantly in the next few years, and the growth rate of aromatic hydrocarbon production capacity is expected to decline.

MDI has less new capacity and high industry concentration

In the past two years, the growth of global MDI capacity has slowed down. The new capacity is mainly from China, while the capacity of the other regions is basically stable. In region, by 2022, global MDI capacity is mainly distributed in China and Europe, accounting for 70% of the total. Since 2015, global MDI capacity growth has been below 10%, mainly due to the slowdown in downstream demand growth. In 2022, the global MDI production capacity will exceed 10 million tons, with a growth rate of 4.8%. Among them, the new capacity mainly from China, the rest of the region remains stable. In the past five years, domestic MDI has greatly expanded production. In 2022, domestic MDI capacity reached 4.36 million tons per year, with a year-on-year growth of 10%, which is mainly driven by national policies. In 2022, China issued the Guidance on Promoting the High-quality Development of the Petrochemical Industry during the 14th Five-Year Plan to encourage and support the development of the MDI industry.

The global MDI industry concentration is high, basically monopolized by a few giant enterprises. In 2022, the world's top five MDI suppliers are Wanhua Chemical, BASF, Kos Chuang, Huntsman and Dow, which together account for more than 90% of the market share. Among them, Wanhua Chemical's MDI production capacity accounted for more than 30% of the global total production capacity in 2022, and it is currently the world's largest MDI supplier.

Main line four: new materials and new technology, the localization of the right time

POE is an ideal material for photovoltaic film, with excellent comprehensive performance

POE is a kind of high-end polyolefin material, mainly under the condition of metallocene catalyst by ethylene and α -olefin (1-1-butyene, 1-octyene, 1-hexene, etc.) in situ polymerization, the polyethylene chain section crystallization zone play the role of physical crosslinking point, with typical plastic properties, the introduction of α -olefin and make it form the elastic amorphous rubber phase, unique structure makes the POE show excellent toughness and good processability. In addition, POE also has anti-aging, anti-ultraviolet light, strong water vapor barrier and many other excellent performance, so it is widely used in photovoltaic, automobile, wire and cable and other fields. From the perspective of downstream application structure, in 2021, photovoltaic has surpassed the automobile to become the largest downstream application field of POE in China. POE is mainly used as packaging film in photovoltaic modules, which plays a role in protecting and enhancing the battery.

POE industrialization needs to conquer the three core processes

Metlocene catalyst: Due to the long α -olefin chain, large steric resistance and asymmetry, the polymerization has low catalytic activity and regional selectivity, which puts forward higher requirements for the selection of catalyst, and needs to develop suitable metallocene catalyst. At present, the main catalysts used in commercial POE production are Bridge YEM catalyst and CGC catalyst. CGC catalyst was synthesized and patented by Dow in 1991, and the initial generation patent has expired, but to produce photovoltaic grade POE, more structural adjustments are still needed. At present, the domestic research and development of metallic catalyst mainly relies on petrochina, Sinopec, universities and research institutes and Wanhua Chemical and other petrochemical enterprises.

α -olefin: α -olefin refers to the double bond in the molecular chain end of single olefin, and ethylene polymerization production POE α -olefin mainly includes 1-butyene, 1-hexene, 1-ene three, at present domestic 1-butyene supply is sufficient, 1-hexene capacity, and in the mainstream application of 1-ocene is still not realized industrialization, mainly face catalyst expensive, catalytic activity, selective defects, the current satellite chemical walk in the domestic α -olefin industrialization.

The preparation of carbon dioxide has high utilization rate and significant energy saving and emission reduction effect

Polyether carbonate polyol, also known as carbon dioxide polyol, is a class of oligomer polyol with terminal hydroxyl group and main chain containing both polyester and polyether chain segment. Its preparation mainly consists of ring opening polymerization of cyclic carbonate and CO2-epoxy regulation copolymerization. The synthesis of polyol from carbon dioxide as raw material has the advantages of high atomic utilization rate, good process economy and great potential for energy saving and emission reduction, which has become the main technical direction of renewable carbon research.

The study found that based on CO2 and propylene oxide (PO) polymerization of polycarbonate PU has a unique hydrolysis resistance, UV resistance and oxidation resistance, can, has the advantages of both polyether PU and polyester PU, but the raw material cost is 10%~20% lower, at the same time, the researchers found that this method can reduce CO2 emissions by 11% -19%, reduce 13% -16% of fossil resources consumption.

Report excerpts: